The Best EU Countries for US Remote Workers

The Best EU Countries for US Remote Workers: A Comprehensive Guide (2025)

1. Introduction

The Remote Work Revolution

The landscape of work has fundamentally shifted over the past five years. What began as a pandemic-driven necessity has evolved into a permanent transformation of how Americans approach their careers. According to recent studies, over 35% of US workers now have the option to work remotely, with 16% working entirely from home. This newfound flexibility has opened doors that were previously unimaginable for many professionals.

For the first time in history, a software engineer in San Francisco can maintain their Silicon Valley salary while living in a charming Portuguese village, or a marketing executive from New York can run campaigns from a beachside cafe in Barcelona. This geographic arbitrage, combined with the desire for new experiences and improved work-life balance, has created a massive migration of US remote workers seeking opportunities abroad.

Why the EU is Becoming a Remote Work Haven

The European Union has emerged as the premier destination for American remote workers, and for compelling reasons. The continent offers a unique combination of factors that make it particularly attractive to location-independent professionals:

Infrastructure and Connectivity: Europe boasts some of the world's best internet infrastructure, with many cities offering fiber-optic speeds that surpass those commonly available in the US. Countries like Estonia and the Netherlands lead globally in digital infrastructure rankings.

Quality of Life: European countries consistently rank among the world's happiest and most livable nations. Universal healthcare, extensive public transportation, rich cultural heritage, and strong social safety nets create an environment where work-life balance isn't just a buzzword—it's a way of life.

Geographic Diversity: Within the EU, remote workers can experience Mediterranean beaches, Alpine mountains, Nordic forests, and cosmopolitan cities, all while maintaining legal residency and the right to move freely between 27 countries.

Growing Recognition: European governments have recognized the economic benefits of attracting remote workers. Many countries have introduced specific visa programs targeting digital nomads and location-independent professionals, streamlining what was once a bureaucratic nightmare.

Cultural and Educational Opportunities: Living in Europe provides unparalleled access to world-class museums, historical sites, diverse languages, and educational opportunities that can enrich both personal and professional life.

Time Zone Advantages: For many US remote workers, European time zones offer better alignment with global business hours, particularly for those working with international clients or teams.

The combination of these factors has created what many consider a "perfect storm" for remote work migration, with EU countries actively competing to attract the best international talent.

2. Key Criteria for Evaluation

Visa and Residency Options for Remote Workers

The foundation of any successful remote work relocation lies in obtaining proper legal status. The visa landscape for remote workers in Europe has evolved dramatically:

Digital Nomad Visas: A growing number of EU countries now offer specialized visas for remote workers, typically requiring proof of employment with a non-EU company and minimum income thresholds ranging from €2,000 to €4,000 monthly.

Freelance/Self-Employment Visas: Many countries offer pathways for freelancers and consultants, though these often require more comprehensive business plans and local tax obligations.

Investor/Entrepreneur Visas: For those with substantial capital, investment-based residency programs offer paths to permanent residency and eventual citizenship.

EU Blue Card: Highly skilled professionals may qualify for this EU-wide work permit, which provides significant benefits and mobility within the union.

Cost of Living and Quality of Life

Cost of living varies dramatically across the EU, but many locations offer significant savings compared to major US cities:

Housing Costs: While cities like Paris and Amsterdam rival New York in expense, countries like Portugal, Spain, and Estonia offer high-quality housing at 50-70% less than comparable US locations.

Healthcare: Universal healthcare systems provide peace of mind and significant cost savings, with many countries offering coverage to legal residents regardless of employment status.

Transportation: Extensive public transportation networks reduce or eliminate the need for car ownership, providing both cost savings and environmental benefits.

Daily Expenses: Food, entertainment, and general living costs are often significantly lower than US equivalents, particularly in Southern and Eastern European countries.

Internet Infrastructure and Coworking Availability

For remote workers, reliable internet isn't a luxury—it's a necessity:

Connection Speeds: Many EU countries offer faster and more reliable internet than the US average, with fiber-optic networks widely available in urban areas.

Coworking Spaces: The rise of remote work has led to an explosion of coworking spaces across Europe, with cities like Berlin, Barcelona, and Lisbon becoming global hubs for digital nomads.

Digital Infrastructure: Countries like Estonia have embraced digital governance, offering services like e-Residency that allow remote workers to establish EU-based businesses entirely online.

Tax Implications and Business Ease

Understanding tax obligations is crucial for remote workers:

Tax Residency Rules: Most EU countries determine tax residency based on physical presence (typically 183 days per year), but rules vary significantly.

Double Taxation Treaties: The US has tax treaties with most EU countries, helping prevent double taxation on income.

Business Registration: Some countries make it exceptionally easy to register as a freelancer or start a business, while others require more complex procedures.

VAT and Local Taxes: Understanding local tax obligations, including VAT for service providers, is essential for compliance.

Language, Cultural Integration, and Expat Communities

Success in a new country often depends on cultural adaptation:

Language Requirements: While English proficiency is high in many EU countries, local language skills can significantly improve integration and business opportunities.

Expat Communities: Large, established expat communities can provide support, networking opportunities, and a smoother transition.

Cultural Compatibility: Understanding local business culture, social norms, and lifestyle preferences helps ensure long-term satisfaction.

Healthcare Access and Safety

Personal security and healthcare access are fundamental considerations:

Healthcare Systems: EU countries generally offer universal healthcare with high-quality services, though access for non-residents varies.

Safety Rankings: Most EU countries rank among the world's safest, with low crime rates and stable political environments.

Emergency Services: Comprehensive emergency services and social safety nets provide security for residents.

3. Top EU Countries for US Remote Workers

Portugal: The Digital Nomad Paradise

Portugal has positioned itself as Europe's premier destination for remote workers, and for good reason. The country offers a compelling combination of affordable living costs, excellent infrastructure, and a welcoming attitude toward international professionals.

Overview and Remote Work Suitability

Portugal's appeal to remote workers stems from its unique position as a Western European country with Eastern European prices. The nation has invested heavily in digital infrastructure and has actively courted international talent through progressive visa policies. With over 300 days of sunshine annually, a rich cultural heritage, and a laid-back lifestyle, Portugal offers an quality of life that's hard to match.

The country's location provides easy access to both Europe and Africa, with Lisbon serving as a major hub for flights to the Americas. The Portuguese government has embraced remote work, with initiatives like the "Tech Visa" and various startup programs demonstrating their commitment to attracting international talent.

Visa Options for Remote Workers

D7 Visa (Passive Income Visa):

- Requirements: Proof of €7,200 annual income (minimum)

- Duration: Initially 2 years, renewable

- Benefits: Path to permanent residency and citizenship

- Processing time: 60-90 days

Digital Nomad Visa (introduced 2022):

- Requirements: €2,760 monthly income minimum

- Duration: 1 year, renewable

- Benefits: Allows remote work for foreign employers

- Processing time: 30-60 days

D2 Visa (Entrepreneur/Investor):

- Requirements: Business plan and €5,000+ investment

- Duration: 2 years initially

- Benefits: Allows local business operations

- Processing time: 90-120 days

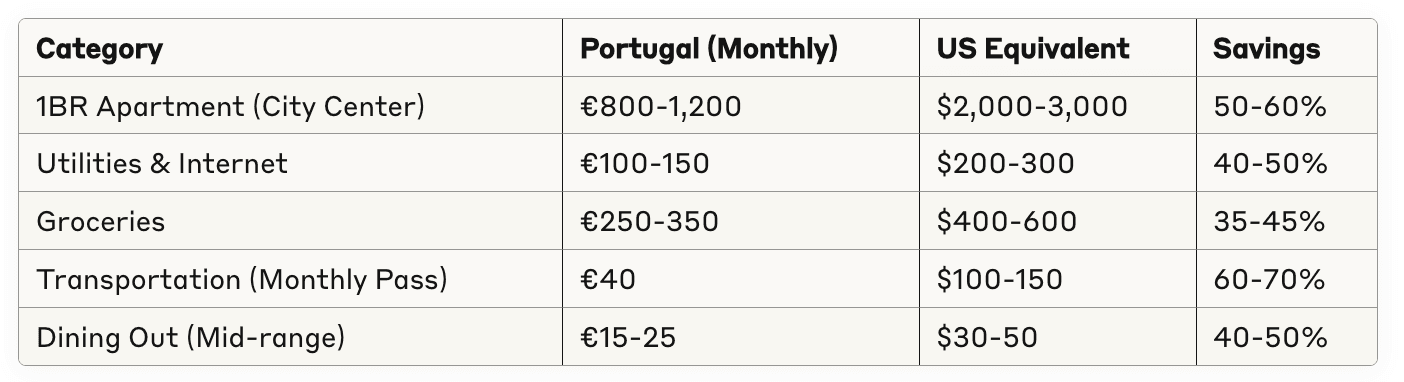

Cost of Living Comparison

Portugal offers exceptional value compared to US standards:

Total Monthly Cost: €1,200-1,800 vs. US equivalent of $2,500-4,000

Quality of Life Factors

Housing: Portugal offers diverse housing options from modern apartments in Porto and Lisbon to traditional homes in smaller towns. The rental market is competitive in major cities but offers good value. Many remote workers find success in smaller coastal towns like Cascais or Óbidos.

Healthcare: Portugal's National Health Service (SNS) provides universal coverage. Private healthcare is also available and affordable. Many procedures cost 70-80% less than US equivalents.

Safety: Portugal ranks as one of the world's safest countries, with low crime rates and a stable political environment. The Global Peace Index consistently ranks Portugal in the top 10 safest countries globally.

Climate: Mediterranean climate with mild winters and warm summers. The southern regions enjoy year-round pleasant weather, while the north experiences more rainfall but remains temperate.

Tax Considerations

Non-Habitual Resident (NHR) Program:

- Benefits: 10 years of tax benefits for new residents

- Foreign income: Potentially tax-free if taxed in source country

- Portuguese income: Flat 20% tax rate on certain professional income

- Requirements: No Portuguese tax residency in previous 5 years

Regular Tax Residency:

- Progressive rates: 14.5% to 48% based on income

- Deductions: Various deductions available

- US tax treaty: Prevents double taxation

Language and Cultural Integration

English Proficiency: High, especially in urban areas and among younger populations. Portugal ranks 7th globally in English proficiency.

Expat Community: Large and growing, with established communities in Lisbon, Porto, and coastal areas. Facebook groups and meetup organizations provide strong support networks.

Cultural Factors: Portuguese culture values work-life balance, with longer lunch breaks and later dinner times. The pace of life is generally slower than US standards, which many remote workers find refreshing.

Internet and Digital Infrastructure

Connection Speeds: Average 100+ Mbps fiber-optic widely available in urban areas Reliability: 99.5%+ uptime in major cities Coworking Spaces: Over 50 coworking spaces in Lisbon alone, with growing numbers in Porto and other cities 5G Coverage: Expanding rapidly across the country

Spain: Mediterranean Lifestyle with Global Connectivity

Spain combines the allure of Mediterranean living with robust infrastructure and a large expat community, making it an attractive destination for US remote workers seeking both culture and convenience.

Overview and Remote Work Suitability

Spain's appeal lies in its diverse regions, each offering unique advantages for remote workers. From the cosmopolitan energy of Barcelona to the historical charm of Seville, the beach lifestyle of Valencia, or the business opportunities in Madrid, Spain provides options for every preference. The country's high quality of life, excellent healthcare system, and strong digital infrastructure make it particularly suitable for long-term remote work arrangements.

The Spanish government has shown increasing interest in attracting international talent, with various regional governments offering specific programs for entrepreneurs and remote workers. The country's position as a gateway between Europe and Latin America also provides unique business opportunities.

Visa Options for Remote Workers

Digital Nomad Visa (Spain Startup Law 2022):

- Requirements: €2,000+ monthly income

- Duration: 1 year, renewable up to 5 years

- Benefits: Work for foreign employers, travel within EU

- Processing time: 30-45 days

Non-Lucrative Visa:

- Requirements: €2,400 monthly passive income

- Duration: 1 year, renewable

- Limitations: Cannot work for Spanish companies

- Processing time: 30-90 days

Investor/Entrepreneur Visa:

- Requirements: €500,000+ investment or innovative business plan

- Duration: 2 years initially

- Benefits: Allows business operations

- Processing time: 90-120 days

Cost of Living Analysis

Spain offers good value, though costs vary significantly by region:

Regional Variations:

- Madrid/Barcelona: Higher costs, similar to mid-tier US cities

- Valencia/Seville: Moderate costs, excellent value

- Smaller cities: Significant savings possible

Quality of Life Assessment

Housing: Spain offers diverse housing options from modern apartments to traditional homes. The rental market is competitive in major cities but generally offers good value. Many remote workers prefer smaller cities like Granada or San Sebastián for better value and quality of life.

Healthcare: Spain's healthcare system consistently ranks among the world's best. Universal coverage is available to residents, with excellent private options also available at reasonable costs.

Safety: Spain is very safe, with low crime rates and stable governance. Tourist areas may have petty crime, but overall security is excellent.

Climate: Varies by region from Mediterranean coastal areas to continental interior climates. Most regions enjoy abundant sunshine and mild winters.

Tax Implications

Beckham Law (Special Tax Regime):

- Benefits: 24% flat tax rate for 6 years

- Eligibility: New residents with high-value employment

- Requirements: Not a Spanish tax resident in previous 10 years

Standard Tax Residency:

- Progressive rates: 19% to 47% based on income

- Regional variations: Autonomous communities set their own rates

- Deductions: Various professional and personal deductions available

Language and Cultural Considerations

English Proficiency: Moderate, higher in tourist areas and among younger populations. Spain ranks 25th globally in English proficiency.

Expat Communities: Large and established, particularly in Madrid, Barcelona, and coastal areas. Strong support networks and social opportunities.

Cultural Integration: Spanish culture emphasizes relationships and work-life balance. The siesta tradition is disappearing in business contexts, but social life remains important.

Digital Infrastructure

Internet Quality: Excellent in urban areas, with widespread fiber-optic coverage Average Speeds: 50-100 Mbps commonly available Coworking Spaces: Over 200 spaces across the country, with Barcelona and Madrid leading 5G Rollout: Progressing rapidly in major cities

Estonia: The Digital Pioneer

Estonia has revolutionized digital governance and offers unique advantages for tech-savvy remote workers, particularly those interested in the European startup ecosystem.

Overview and Remote Work Suitability

Estonia's digital transformation is unparalleled globally. The country offers e-Residency, allowing anyone worldwide to establish a European business entirely online. This digital-first approach extends to all aspects of life, making Estonia particularly attractive to remote workers in technology and digital services.

Despite its small size, Estonia punches above its weight in terms of digital infrastructure and startup ecosystem. The country has produced unicorns like Skype and Wise, and continues to be a hub for European tech innovation.

Visa Options for Remote Workers

Digital Nomad Visa:

- Requirements: €3,500 monthly income

- Duration: 1 year, renewable

- Benefits: Work for foreign employers, EU travel

- Processing time: 15-30 days

Startup Visa:

- Requirements: Innovative business idea and €1,600 monthly income

- Duration: 18 months

- Benefits: Path to permanent residency

- Processing time: 30-45 days

e-Residency Program:

- Benefits: Establish EU business online

- Limitations: Doesn't provide physical residency

- Cost: €120 application fee

- Processing time: 15-30 days

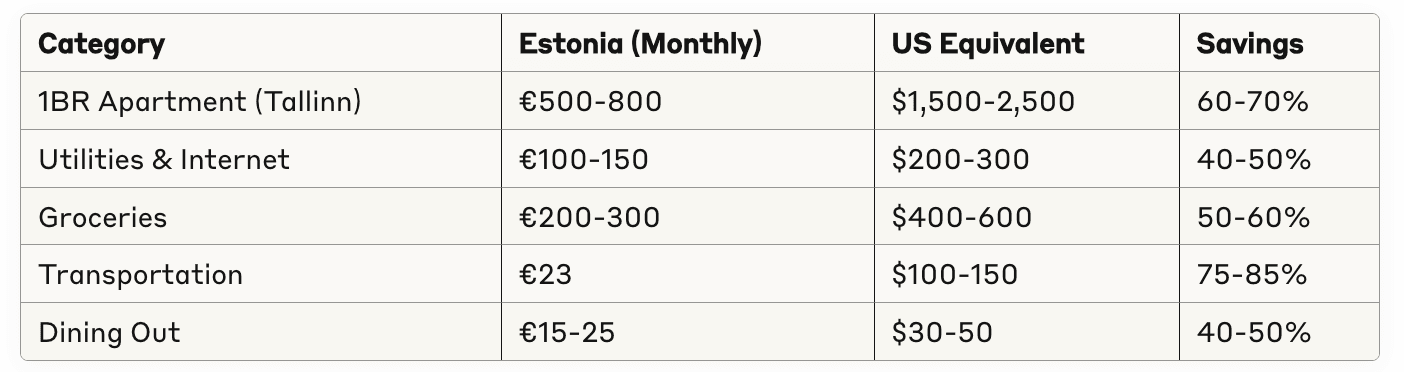

Cost of Living Details

Estonia offers excellent value, especially considering its high quality of life:

Total Monthly Cost: €800-1,200 vs. US equivalent of $2,000-3,500

Quality of Life Factors

Housing: Tallinn offers modern apartments and traditional architecture. The rental market is competitive but affordable by Western standards. Many remote workers enjoy the medieval Old Town area.

Healthcare: Estonia's digital healthcare system is among the world's most advanced. Universal coverage provides excellent care with minimal bureaucracy.

Safety: Estonia is extremely safe, with low crime rates and high levels of social trust. The country consistently ranks among the world's safest.

Climate: Continental climate with cold winters and mild summers. The winter months can be challenging for those unused to limited daylight.

Tax Considerations

Tax Residency: Based on 183-day rule Corporate Tax: 0% on retained earnings (unique system) Personal Income Tax: Flat 20% rate Startup Benefits: Various tax incentives for startups and tech companies

Language and Digital Integration

English Proficiency: Very high, especially in Tallinn and among younger populations. Estonia ranks 6th globally in English proficiency.

Digital Services: 99% of government services available online, including tax filing, business registration, and healthcare appointments.

Expat Community: Growing but smaller than other destinations. Strong startup and tech communities provide networking opportunities.

Internet and Tech Infrastructure

World-Class Connectivity: Estonia leads globally in digital infrastructure rankings Internet Speed: Average 100+ Mbps with gigabit fiber widely available Digital Government: Fully digital government services set global standards 5G Coverage: Comprehensive rollout across the country

Germany: Economic Powerhouse with Stability

Germany offers stability, strong economy, and excellent infrastructure, making it attractive for remote workers seeking long-term opportunities in Europe's largest economy.

Overview and Remote Work Suitability

Germany's robust economy, central European location, and strong rule of law make it an attractive destination for remote workers, particularly those in business services, consulting, and technology. The country's strong social safety net and excellent infrastructure provide security and reliability.

While Germany may not offer the cost savings of other EU destinations, it provides unparalleled economic stability and opportunities for career advancement. The country's position at the heart of Europe makes it an excellent base for business across the continent.

Visa Options for Remote Workers

Freelance Visa (Freiberufler):

- Requirements: Professional qualifications and business plan

- Duration: 1-3 years initially

- Benefits: Work as freelancer/consultant

- Processing time: 60-90 days

Job Seeker Visa:

- Requirements: University degree and financial resources

- Duration: 6 months to find employment

- Benefits: Can lead to work visa

- Processing time: 30-60 days

EU Blue Card:

- Requirements: University degree and €56,400+ annual salary

- Duration: 4 years maximum

- Benefits: Permanent residency pathway

- Processing time: 30-90 days

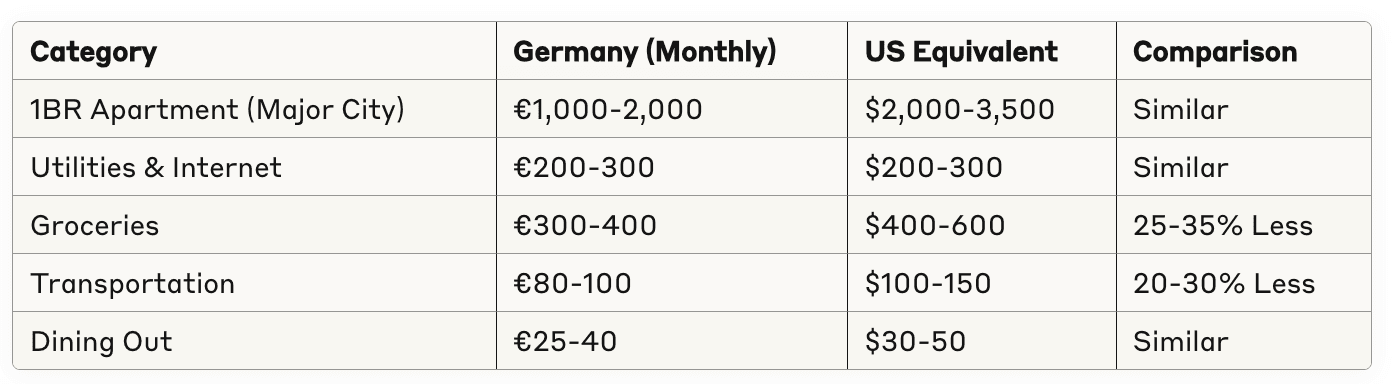

Cost of Living Analysis

Germany's costs are moderate to high but vary significantly by region:

Regional Variations:

- Munich/Frankfurt: Most expensive, comparable to major US cities

- Berlin: Moderate costs, excellent value for capital city

- Smaller cities: Significant savings possible

Quality of Life Assessment

Housing: Germany offers high-quality housing with strong tenant protections. The rental market can be competitive in major cities, but standards are generally excellent.

Healthcare: Germany's healthcare system is among the world's best, with universal coverage and excellent quality of care.

Safety: Germany is very safe with low crime rates and stable governance. The country consistently ranks among the world's safest.

Climate: Continental climate with four distinct seasons. Winters can be cold and dark, while summers are generally pleasant.

Tax Implications

Tax Rates: Progressive system from 14% to 45% Church Tax: 8-9% additional tax if registered with a church Social Security: Mandatory contributions of ~20% of income Freelancer Benefits: Various deductions available for business expenses

Language and Cultural Factors

English Proficiency: Good in business contexts and urban areas, but German language skills highly beneficial for integration and business success.

Expat Communities: Large and established, particularly in major cities. Strong support networks and integration programs.

Work Culture: Germans value punctuality, efficiency, and work-life balance. The concept of "Feierabend" (end of work day) is strongly respected.

Digital Infrastructure

Internet Quality: Excellent in urban areas, though fiber rollout has been slower than some EU neighbors Average Speeds: 50-100 Mbps commonly available Coworking Spaces: Over 300 spaces across the country, with Berlin leading as a startup hub Digital Services: Increasingly digital government services, though still developing

Croatia: Adriatic Paradise with EU Benefits

Croatia combines stunning natural beauty with EU membership benefits, making it an increasingly popular destination for remote workers seeking lifestyle and value.

Overview and Remote Work Suitability

Croatia's appeal lies in its combination of Mediterranean lifestyle, EU membership benefits, and affordable living costs. The country's stunning Adriatic coastline, rich history, and growing digital infrastructure make it particularly attractive to remote workers seeking a high quality of life.

As one of the EU's newer members, Croatia is actively working to attract international talent and investment. The country's strategic location and growing tech sector provide opportunities for remote workers and entrepreneurs.

Visa Options for Remote Workers

Digital Nomad Visa:

- Requirements: €2,300 monthly income

- Duration: 1 year, renewable

- Benefits: Work for foreign employers, EU travel

- Processing time: 30-45 days

Freelance Visa:

- Requirements: Business plan and financial resources

- Duration: 1 year initially

- Benefits: Work as freelancer in Croatia

- Processing time: 45-60 days

EU Citizenship by Investment:

- Requirements: €350,000+ investment

- Duration: 3-5 years to citizenship

- Benefits: Full EU citizenship

- Processing time: 12-18 months

Cost of Living Comparison

Croatia offers excellent value, particularly outside major tourist areas:

Coastal Premium: Coastal areas like Dubrovnik and Split command higher prices, especially during tourist season.

Quality of Life Factors

Housing: Croatia offers diverse housing from modern apartments in Zagreb to traditional stone houses along the coast. The rental market is competitive in tourist areas but generally affordable.

Healthcare: Croatia's healthcare system provides universal coverage with good quality care. Private healthcare is also available and affordable.

Safety: Croatia is very safe with low crime rates. The country is politically stable and has strong rule of law.

Climate: Mediterranean climate along the coast with continental climate inland. Coastal areas enjoy mild winters and warm summers perfect for outdoor activities.

Tax Considerations

Tax Residency: Based on 183-day rule Income Tax: Progressive rates from 20% to 30% Digital Nomad Benefits: Special tax regime for digital nomads with reduced rates EU Benefits: Freedom of movement and business establishment throughout EU

Language and Cultural Integration

English Proficiency: Good, especially in tourist areas and among younger populations. Croatia ranks 13th globally in English proficiency.

Expat Communities: Growing communities, particularly in Zagreb and coastal areas. Strong support networks developing.

Cultural Factors: Croatians value family, tradition, and work-life balance. The pace of life is generally relaxed, especially along the coast.

Digital Infrastructure

Internet Quality: Good and improving rapidly, with fiber-optic networks expanding Average Speeds: 30-60 Mbps commonly available, higher in urban areas Coworking Spaces: Growing number of spaces, particularly in Zagreb and Split Digital Services: Government services increasingly digitized

Netherlands: Innovation Hub with Global Outlook

The Netherlands offers world-class infrastructure, progressive policies, and a highly international business environment, making it attractive for remote workers seeking opportunities in Europe's most connected economy.

Overview and Remote Work Suitability

The Netherlands stands out for its exceptional English proficiency, progressive business environment, and central European location. The country's "polder model" of cooperation and consensus-building creates a stable, predictable environment for business and life.

Amsterdam and other major cities serve as European headquarters for many multinational corporations, providing opportunities for remote workers to connect with global business networks. The country's flat geography and excellent public transportation make it easy to explore.

Visa Options for Remote Workers

Dutch-American Friendship Treaty (DAFT):

- Requirements: US citizenship and €4,500 investment

- Duration: 2 years, renewable

- Benefits: Self-employment authorization

- Processing time: 30-60 days

EU Blue Card:

- Requirements: University degree and €5,403+ monthly salary

- Duration: 4 years maximum

- Benefits: Path to permanent residency

- Processing time: 90 days

Startup Visa:

- Requirements: Innovative business plan and facilitator

- Duration: 1 year

- Benefits: Establish startup in Netherlands

- Processing time: 60-90 days

Cost of Living Analysis

The Netherlands has high costs but offers excellent quality of life:

Regional Variations: Amsterdam is most expensive, while smaller cities offer better value.

Quality of Life Assessment

Housing: High-quality housing with strong tenant protections. The rental market is competitive, especially in Amsterdam and other major cities.

Healthcare: Excellent healthcare system with mandatory insurance. High quality care with reasonable costs.

Safety: Very safe with low crime rates and stable governance. The Netherlands consistently ranks among the world's safest countries.

Climate: Maritime climate with mild temperatures year-round. Frequent rainfall but rarely extreme weather.

Tax Implications

30% Tax Ruling: Significant tax benefit for international workers Progressive Rates: 37.35% to 49.5% depending on income Tax Treaty: Comprehensive treaty with US prevents double taxation Business Benefits: Favorable tax environment for businesses

Language and Cultural Factors

English Proficiency: Exceptional - Netherlands ranks 1st globally in English proficiency Expat Communities: Large and well-established international communities Cultural Integration: Dutch culture values directness, efficiency, and work-life balance Business Environment: Highly international and English-speaking

Digital Infrastructure

World-Class Connectivity: Netherlands leads globally in digital infrastructure Internet Speed: Average 100+ Mbps with gigabit fiber widely available Coworking Spaces: Over 100 spaces across the country, with Amsterdam leading Digital Government: Highly digitized government services

Greece: Mediterranean Charm with EU Access

Greece offers an exceptional combination of lifestyle, culture, and affordability, making it increasingly attractive to remote workers seeking Mediterranean living with EU benefits.

Overview and Remote Work Suitability

Greece's appeal lies in its unique combination of ancient history, island lifestyle, and modern EU infrastructure. The country has rebounded strongly from its economic crisis and is actively courting international talent and investment.

The Greek islands offer an unparalleled lifestyle for remote workers, while Athens provides urban amenities and business opportunities. The country's strategic location between Europe, Asia, and Africa provides unique perspectives and opportunities.

Visa Options for Remote Workers

Digital Nomad Visa:

- Requirements: €3,500 monthly income

- Duration: 1 year, renewable

- Benefits: Work for foreign employers, EU travel

- Processing time: 30-45 days

Independent Means Visa:

- Requirements: €2,000 monthly passive income

- Duration: 1 year, renewable

- Benefits: Residency without work authorization

- Processing time: 45-60 days

Golden Visa Program:

- Requirements: €250,000+ property investment

- Duration: 5 years, renewable

- Benefits: Residency for investor and family

- Processing time: 60-90 days

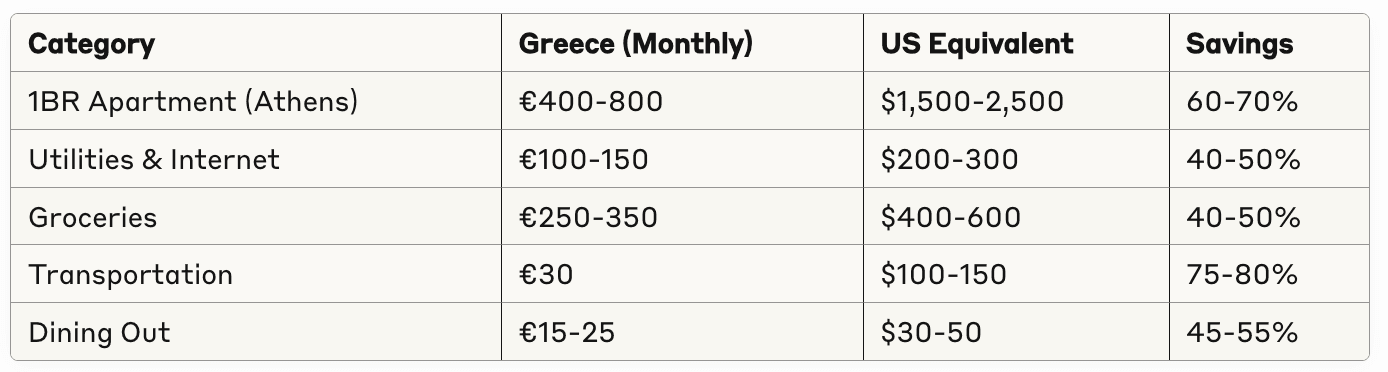

Cost of Living Comparison

Greece offers excellent value, especially outside Athens:

Island Premium: Popular islands like Mykonos and Santorini command higher prices, while lesser-known islands offer exceptional value.

Quality of Life Assessment

Housing: Greece offers diverse housing from modern apartments in Athens to traditional homes on islands. The rental market is generally affordable with good availability.

Healthcare: Greece's healthcare system provides universal coverage. Private healthcare is also available and affordable.

Safety: Greece is very safe with low crime rates. The country is politically stable despite economic challenges.

Climate: Mediterranean climate with mild winters and warm, dry summers. Islands enjoy year-round pleasant weather.

Tax Implications

Tax Residency: Based on 183-day rule Income Tax: Progressive rates from 9% to 44% Special Tax Regime: Available for new residents with foreign income EU Benefits: Freedom of movement and business establishment

Language and Cultural Integration

English Proficiency: Good in tourist areas and among educated populations. Greece ranks 16th globally in English proficiency.

Expat Communities: Growing communities, particularly in Athens and popular islands. Strong support networks developing.

Cultural Factors: Greeks value family, tradition, and leisure time. The pace of life is relaxed, with emphasis on enjoying life.

Digital Infrastructure

Internet Quality: Good and improving, with fiber-optic networks expanding in urban areas Average Speeds: 25-50 Mbps commonly available, higher in cities Coworking Spaces: Growing number of spaces, particularly in Athens and Thessaloniki Digital Services: Government services increasingly digitized

4. Case Studies and Testimonials

Sarah Martinez, Software Developer - Lisbon, Portugal

"I moved to Lisbon in 2023 after getting tired of paying $3,500 for a tiny apartment in San Francisco. Here, I have a beautiful 2-bedroom apartment in Príncipe Real for €1,200, and I can walk to amazing restaurants and cafes every day. The NHR tax program means I'm paying significantly less in taxes, and the quality of life is incredible. I've learned Portuguese, made local friends, and I'm actually saving money while living better than I ever did in the US."

Key Success Factors:

- Utilized NHR tax program for significant savings

- Chose central location for community access

- Invested time in language learning

- Maintained US salary while reducing costs by 60%

Michael Chen, Marketing Consultant - Berlin, Germany

*"Berlin was perfect for my consulting business because it's in the heart of Europe, making client meetings across the continent much easier. The freelance visa process was straightforward, and the city's startup ecosystem has provided numerous opportunities. Yes, it's more expensive than some